What’s in the 2024-25 Mid-Year Economic Review?

The bombshell in the Mid-Year Economic and Fiscal Outlook (MYEFO) 2024–25 was the increase in the budget deficit by over $21.8bn over the next 4 years. Debt is forecast to reach over $1 trillion from 2025-26.

For accountants and advisers, beyond Government spending and the estimated reduction in company tax receipts - company tax receipts have been revised downwards for the first time since the 2020–21 Budget, reflecting weaker commodity volumes amid emerging challenges in the Chinese economy – there were a few specific items of interest:

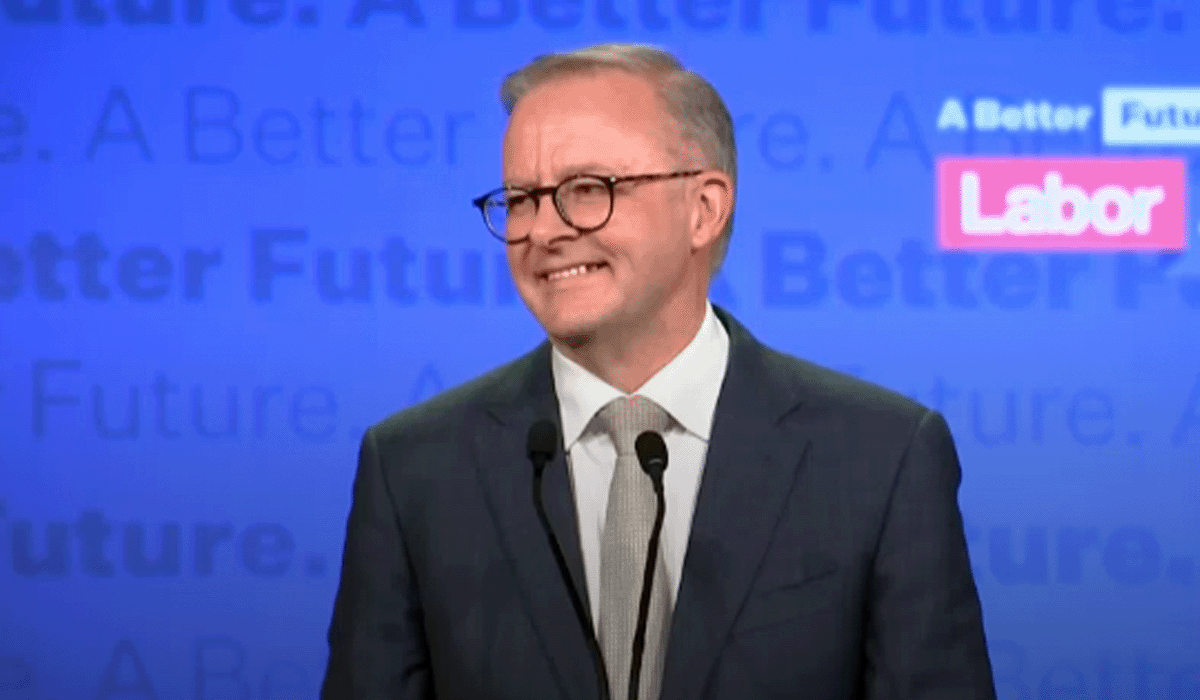

Election prepping

Around $5.5bn in additional spending over four years has been set aside for policy decisions that have been made but not announced.

An election must be held no later than 17 May 2025. The Federal Budget is currently set down for 25 March 2025. With a burgeoning deficit it will be interesting to see whether the Government settle on February, March or May 2025 to go to the polls. There is doubt that the Government will want to present another Budget pre-election. The Budget numbers are not helpful. Household consumption is forecast down to 1% growth in 2024-25 from 2%, and Government spending has risen to 5.7%, an increase of $58.3bn.

As renowned psephologist Antony Green points out, Australia has never had a January or February election. May and March are much more popular months. However, the potential timeline is complicated by the next Western Australian election set for Saturday, 8 March 2025. Two elections in one month are understandably not ideal.

Many happy returns expected by the Government from ATO compliance investment

The ATO is the beneficiary of further Government investment designed to breach the tax gap. On top of the existing programs, the Shadow Economy Compliance Program is expected to increase receipts by $366 million, the Phoenix Compliance Program by $278 million, and the modernisation of the tax administration system by over $81 million.

Trust tax returns in the spotlight with prefilled beneficiary details

The modernisation of the tax administration system includes changes to the way in which trust tax returns are managed. This includes a push to enable the “vast majority of trust tax returns to be lodged electronically” including the prefilling of trust income for beneficiaries, in the same way salary and wages, bank interest and other types of income are currently prefilled.

Legislative amendments will be made to require trustees to report the Tax File Numbers (TFNs) of beneficiaries on the trust income tax return’s Statement of Distribution when they have an entitlement.

Penalty tax regime changes

Legislative amendments will be made to amend the operation of the penalty tax regime to:

- From 1 July 2026, ensure tax scheme penalties apply where taxpayers are in a loss position.

- From 1 July 2026, penalise large taxpayers that mischaracterise or undervalue interest or dividend payments, to which withholding tax would otherwise apply.

- Extend the application of the Shortfall Interest Charge to repayments of overclaimed refundable offsets to disincentivise overclaiming, starting from the first 1 January, 1 April, 1 July or 1 October after Royal Assent of the Future Made in Australia (Production Tax Credit and Other Measures) Bill 2024, which was introduced to the House of Representees on 25 November 2024.

Removing the $2 minimum for philanthropic giving and smoothing requirements for PAFs

To encourage philanthropic giving, the Government will:

- Remove the condition that a gift to a deductible gift recipient be valued at $2 or more before claiming a tax deduction (intended to apply to gifts made from 1 July 2024).

- Align and increase the minimum annual distribution rate for public and private ancillary funds (PAFs) and allow ancillary funds to smooth distributions over three years. This will apply from the first financial year after registration of amending ministerial guidelines. The distribution rate will be subject to consultation, and a five‑year grace period will apply to any increase in the minimum distribution rate.

Tobacco and gambling denied access to R&D incentives

Tobacco and gambling activities will be denied access to the Research and Development Tax Incentive for activities on or after 1 July 2025. Activities that are solely for the purpose of harm reduction, such as reducing addiction, will remain eligible to receive support.

$3m super tax still on the agenda

The MYEFO still contemplates the introduction of the proposed Division 296 tax, which imposes a 30% tax rate on future earnings for superannuation balances above $3 million. If enacted, the tax is scheduled to commence from 1 July 2025.

Increased takeover transactions fees

The Government will take an additional $17.1 million in the form of new and increased ASIC fees for takeovers of Australian entities including a public company or listed registered managed investment scheme. For documents lodged from 1 January 2025:

- $195,000 for transactions worth over $500 million

- $145,000 for transactions worth $100 million to $500 million

- $50,000 for transactions worth $35 million to less than $100 million

- $10,000 for transactions worth $10 million to less than $35 million.

Legacy pensions

A new regulation provides a 5-year window of opportunity from 7 December 2024, for a member with either a lifetime defined benefit pension, a life-expectancy defined benefit pension, or market-linked pension, to fully commute that pension back to accumulation phase in the SMSF. This amount can then be used to commence an account-based pension, subject to the member’s transfer balance cap. The amount can also be retained in the member’s accumulation account or withdrawn from superannuation. Read the details in Accurium’s blog Santa delivers for legacy pension recipients.

The measure is expected to cost around $21.7m.

Feature film location offset reduced qualifying threshold

The minimum Qualifying Australian Production Expenditure threshold for the Location Offset for feature films will be reduced from $20 million to $15 million. The Location Offset is a 30% rebate for the production of large-budget film and television projects shot in Australia.

Other measures

- For primary producers, levies for macadamia, apple and pears will increase on 1 Jan 2025.

- A new trade agreement with the United Arab Emirates was signed on 6 November 2024 - The agreement eliminates tariffs on over 99% of Australian exports to the UAE. The agreement will decrease receipts by $54m over 5 years (see Australia-United Arab Emirates Trade Agreement).

More

Share this

You May Also Like

These Related Stories

What we know about Budget 2024-25

What to expect from the new Government

No Comments Yet

Let us know what you think