Working with the small business CGT concessions IQ

Self-paced, interactive training to help you work with the small business CGT concessions ... the right way

Accreditation: FAAA 30887

Total 4.5 CPD hours Tax (financial) Advice

Work with the small business CGT concessions

...the right way

Essential training for accountants and financial advisers

Accountants are often asked to 'manage' the tax on the sale of a small business and financial advisers are expected to know the fundamentals of how the small business CGT rules apply and the implications for clients.

The small business CGT concessions are very generous for those who meet the relevant conditions. However, the rules can also be very complex and difficult to apply in practice and claims made under the concessions are at a high risk of being reviewed by the ATO.

The Working with the Small Business CGT Concessions IQ is an essential, pragmatic self-paced training module that walks you through when and how the concessions apply and the issues that arise in practice.

*Office Registrations. Maximum 1o participants per firm (must have same email domain). The PD points for all attendees will be recognised and links will be provided to all attendees.

Register Now

Just Me

AU $425 members

AU $495 non members

Team (up to 10)

AU $995 members

AU $1,130 non members

Knowledge Shop members, login for the discounted rate.

Self paced, practical training any time, anywhere!

- 4.5 hours in total

- Full reference materials included

- Interactive Q&As

- Practical, insightful training on how to apply the small business CGT concessions in practice

- CPD tracking, manager view of progress

What we cover

- The key concepts and an overview of how the rules work

- The grouping rules - what you need to know before looking at whether a client can access the concessions.

- The basic conditions to access the concessions, how they apply and the order they apply

- Active asset test

- Maximum net asset value test

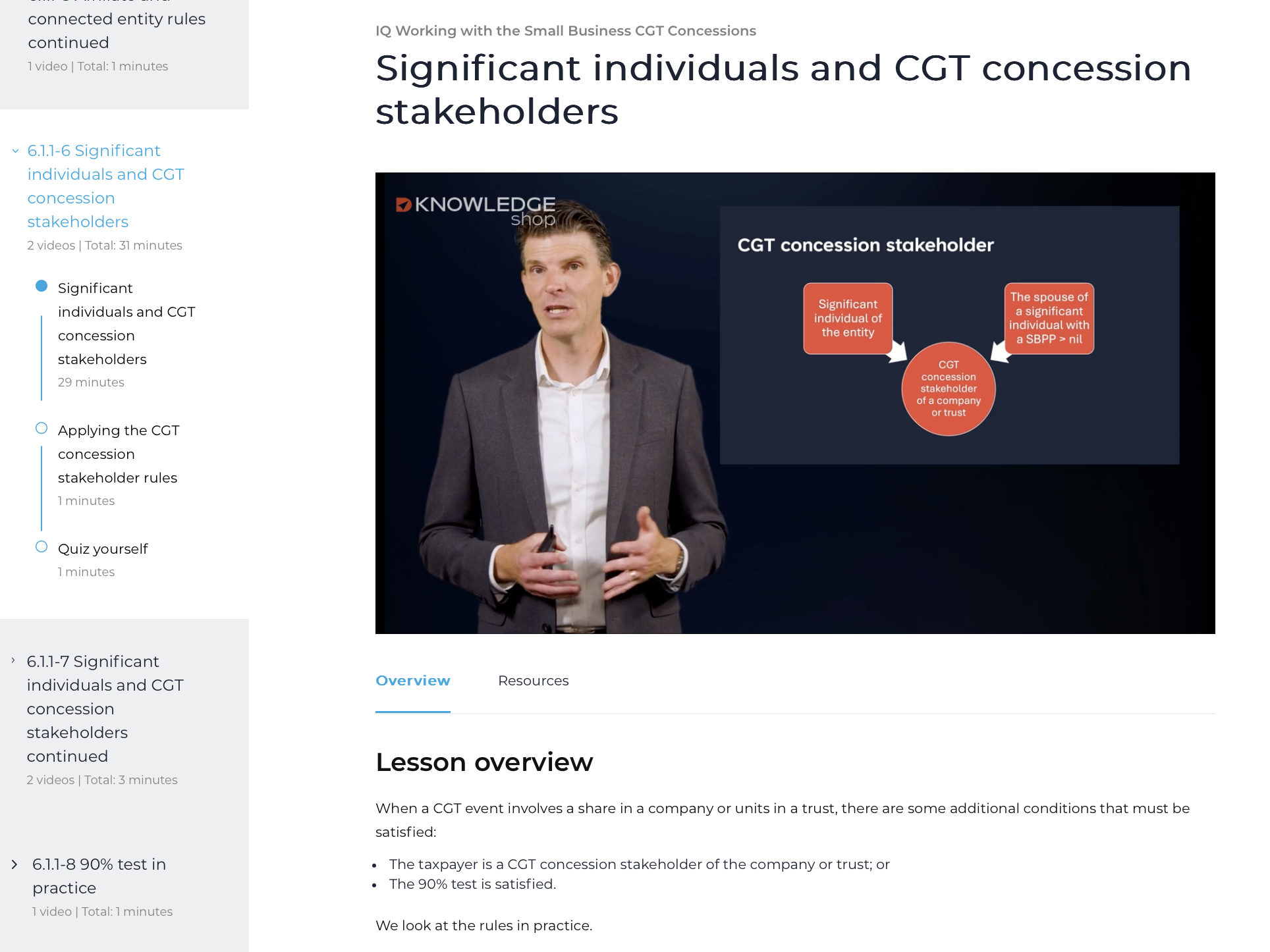

- CGT concession stakeholders

- Other issues including deceased estates

- Special conditions for companies and trusts

- Applying the concessions

- 15 year exemption

- 50% active asset reduction

- Retirement exemption

- Rollover relief

- Reducing risk

Our presenter

Michael Carruthers

Michael is an adviser, author, in demand presenter, mentor to Knowledge Shop’s technical team, and is well known for his capacity to translate highly technical information into tangible and useable advice for the profession. He has a knack for seeing through the complexity and helping advisers work through highly technical issues with certainty and accuracy.

Michael is an adviser, author, in demand presenter, mentor to Knowledge Shop’s technical team, and is well known for his capacity to translate highly technical information into tangible and useable advice for the profession. He has a knack for seeing through the complexity and helping advisers work through highly technical issues with certainty and accuracy.

Michael works with advisers every day to help them negotiate and implement the constant tide of change impacting the industry.

He is a member of the advisory panel for the Board of Taxation and is a member of the reference group for the Board’s review of small business concessions. He was also an expert panel member for the Board’s review of tax impediments facing small business.

Terms & Conditions

Each education service purchase is for your use only and accessible through your individual account. Each live online education service will be provided with a unique session ID to join which cannot be disclosed, forwarded, or distributed to any other individual without Knowledge Shop Pty Ltd's written consent. No other individual will be authorised to access your education service unless that individual has purchased the education service and a unique session ID has been provided to that individual. In the event of unauthorised access due to the actions of the intended recipient, Knowledge Shop Pty Ltd may suspend or cancel the access for the intended recipient any additional individual(s) may be held liable for additional fees associated with the unauthorised access to an education service. Knowledge Shop Pty Ltd reserves the right to charge any unauthorised individual(s) who access your education service. In the unlikely situation that a live education service is cancelled we will refund you the full cost of your purchase. If a live service is postponed, we will provide written notification to you and reschedule the education service. Your original ticket will be valid for the rescheduled date. We will also provide the recording and associated materials if you are unable to attend the education service live at the new date/time. If you are unable to attend the education service live at the new date/time, you may request a refund of the moneys paid by contacting Knowledge Shop Pty Ltd directly, with all requests to be considered on a case by case basis by Knowledge Shop Pty Ltd in its absolute discretion.